Credit Cards

Are Secured Cards a Good Option for Bad Credit? An Honest, Practical Guide

Are secured credit cards for bad credit worth it? Learn real results, key rules, pitfalls to avoid, and simple routines to rebuild your score. Start making informed moves today with our expert insights.

Advertisement

Getting turned down for credit cards feels discouraging, especially if your score has taken a few hits. You may have heard that options like secured credit cards for bad credit can help you reset your footing without risking even more.

This topic matters because millions face financial setbacks and want honest, simple ways to rebuild. Secured credit cards for bad credit promise a second chance, but you need to know exactly how they work and what to expect.

Let’s look at how secured cards function, if they live up to expectations, and what real steps you can take starting today. Read on—this guide sorts myth from fact with examples you’ll recognize.

Understanding Secured Cards: What Sets Them Apart for Bad Credit Rebuilders

Secured credit cards for bad credit offer a real pathway to build or repair your credit. They use cash deposits as collateral, so approval is based on your deposit, not your score.

With secured cards, you get a credit line that typically matches your cash deposit. The card works just like any other: make purchases, pay your bill, and watch your progress get reported to credit bureaus monthly.

Deposit Requirements Shape Your Starting Limit

Secured cards almost always require a refundable deposit, usually between $200 and $1,000. “I can’t risk more than $300 right now,” you might think. That sets your initial credit line.

For example, say you deposit $400. Your card’s limit will be $400 until you add more. Lenders treat the deposit as security against missed payments, so approval is easier even if your credit’s rough.

Unlike unsecured cards, you won’t be offered a higher limit without a bigger deposit. This system keeps you from overspending and lets you practice responsible habits on a smaller scale.

Reporting to Credit Bureaus Moves Your Score Up

Secured credit cards for bad credit send your payment history to all three credit bureaus monthly. This is key for change—each on-time payment builds your track record.

Imagine starting with no recent positive credit. Within six months of steady payments, you’d see new entries on your credit report. “Making each payment felt like undoing a mistake,” one user might say.

As more positive months add up, lenders take notice. You can check your progress using free credit monitoring tools to watch for score improvements.

| Feature | Secured Card | Unsecured Card | Takeaway |

|---|---|---|---|

| Approval Requirements | Low score, deposit needed | Higher score, no deposit | Deposit increases approval odds |

| Initial Credit Limit | Matches your deposit | Set by the issuer | Control your limit size |

| Builds Credit? | Reports monthly | Reports monthly | Both help your credit |

| Risk of Overspending | Low, limited by deposit | Can be high with large limits | Lower temptation with secured |

| Deposit Refundable? | Yes, when closed in good standing | No | Get your money back with secured |

Comparing Secured Card Rules and Outcomes for Everyday Use

Secured cards work best with a system in place. Let’s break down what you’ll encounter daily, plus key rules to follow so you get results—not regrets—from every swipe.

When using secured credit cards for bad credit, adopting clear habits makes the difference between helping or unintentionally hurting your score. Let’s detail two sets of actionable do’s and don’ts.

Daily Habits for Positive Results

Building credit starts with repeatable habits that make life easier. Set up payment reminders or use autopay so you never miss the due date.

For every $100 charged, pay off at least $95 each month. This keeps your credit utilization low—lenders want to see less than 30% of your limit used, ideally less than 10%.

- Pay your balance in full monthly—avoids interest charges and proves responsibility to lenders, which helps boost scores more quickly.

- Set recurring bill payments—reduces stress and lowers the risk of forgetting, streamlining your financial routine.

- Monitor your limit—use less than 30% of your available credit to maximize credit score gains, as high usage can signal risk.

- Check statements regularly—spot unauthorized charges instantly and address them before they cause issues or panic.

- Request a limit increase after 6-12 months—shows progress, but only do this if your payment track record is spotless and your deposit can be raised.

Consistent habits lead to better offers, and you may outgrow secured credit cards for bad credit faster than you expect when each step is intentional.

Key Mistakes to Sidestep

Skipping payments or using up your full limit counteracts any benefits. Late fees, penalty APRs, and reported misses can keep bad credit in place—or make it worse.

Never withdraw cash from your secured card. Cash advances are costly, with steep fees and immediate interest that won’t help you build credit.

- Don’t max out your card—even if your deposit is $500, never use all of it. Stay below $150 for purchases to keep your utilization healthy.

- Don’t pay late—late payments hurt credit fast, undoing positive progress and adding unwanted fees to your account.

- Don’t ignore annual fees—factor these into your budget upfront. If the fee is $49, set a calendar reminder so it doesn’t surprise you.

- Don’t close your card too soon—let it work for at least a year. Sudden closures can reduce your credit age, affecting your score.

- Don’t expect instant results—credit rebuilding is gradual. Monitor your score monthly, but measure success over six to twelve months, not days.

The best path combines steady use and avoiding common pitfalls. Secured credit cards for bad credit yield long-term change when you know what not to do, as well as what’s smart to start now.

When Secured Cards Make Sense: Realistic Rebuilding Roadmaps

If past credit slip-ups follow you, it’s tough to know where to start. Secured credit cards for bad credit offer a practical, permission-based restart for those who feel stuck.

Imagine asking, “Will this help if I just went through bankruptcy?” Yes—secured cards usually approve applications even when your report looks messy, as long as you can fund the deposit needed.

Scenario: The Fresh Start After a Setback

Jessica filed for bankruptcy last year. Now, she’s ready to start fresh but gets declined for standard cards. She applies for a secured card, deposits $350, and is approved.

Over six months, she pays off the small balances she charges. She follows a script: 0Pay bill on the 12th, check balance before buying groceries”. Each positive month rebuilds her future borrowing potential, step by step.

Within a year, Jessica sees a 70-point score jump and receives offers for unsecured cards. Her path is repeatable: start small, don’t overspend, and keep accounts open for momentum.

The Side Gig for Credit Rebuilders

Tom juggles multiple part-time jobs and wants to boost his credit for a car loan. He treats the secured card as a necessary business tool, only using it for gas and ride-share expenses.

His routine is strict: 0If I fill up, I pay the card immediately via mobile app.” By showing consistent payments for gig expenses, lenders see steady performance unrelated to his income level.

After 10 months, his savings have grown—the deposit stays untouched, and his score improves enough for a better car loan rate. He keeps the card active to maintain a positive payment trail.

Transitioning From Secured to Unsecured Cards: Step-by-Step Progress for Higher Scores

Graduating from secured credit cards for bad credit puts your results into action. Success here means you’re ready for rewards, higher limits, and bigger opportunities with no deposit required.

The graduation doesn’t happen automatically. You need a plan with milestones: steady payments, utilization under 30%, and a clean record on your report for at least a year.

Timeline for a Smooth Upgrade

Months 1–3: Charge only what you can pay in full. Never pay late; track via a personal finance app to establish consistency.

Months 4–6: Increase your deposit or ask if the issuer offers automatic reviews. Some cards perform this every six months, but a quick phone call can nudge things along.

Months 7–12: Apply for an entry-level unsecured card if your score has increased by 50–100 points and your payment history is spotless. Consider keeping your secured card open for extra score benefits.

Managing Two Cards for Maximum Score Impact

Using your new unsecured card alongside your secured card builds your credit even faster. “I use one card for streaming services and one for gas,” someone might say. Each card shows usage and repayment skill.

Set up automatic payments for both cards—no mental juggling on due dates. If an issuer won’t graduate your secured card, you can still close it for a deposit refund after your new card is set up.

Check your credit every three months, using free tools to spot jumps and correct errors. Gradual, mindful steps win out over big risks when moving up the credit ladder.

Weighing Risks and Fees: Every Dollar Counts When Credit’s Tight

Every fee matters when aiming to rebuild bad credit. Secured credit cards for bad credit come with deposits, annual fees, and in some cases, monthly maintenance charges.

Some cards offer no annual fee but may ask for a higher deposit. Others may charge $25–$50 per year—worth it if the issuer reports monthly to all three bureaus as promised.

Reading the Fine Print Before You Apply

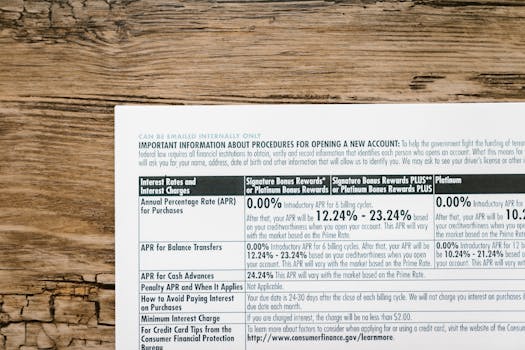

Check the card’s terms for hidden details. “I almost missed the $5 monthly fee!” a reader might report. Issuers disclose all fees in the Schumer box; review this before agreeing.

Look for cards that refund your deposit as soon as you’re eligible for graduation or after closing in good standing. Avoid cards that delay refunds or come with exit fees.

Compare grace periods: some cards give you 25 days to pay each month interest-free, while others have shorter windows. Pick options that fit your pay schedule to avoid unwanted charges.

Managing Fees for the Best Outcome

Set a reminder for annual and monthly fees so they don’t catch you by surprise. Calculate how much you’ll pay in Year One—deposit plus any non-refundable fees—to know your real investment.

If your budget is tight, choose cards with refundable deposits and the lowest recurring charges. Track all expenses using a budget app, especially if you’re juggling multiple payments.

Call customer service if any fee looks unexpected. Many issuers will waive first-time late fees for honest mistakes if you explain your situation calmly and quickly after the bill arrives.

Building Consistent Habits With Secured Cards: Scripting Your Success Story

Creating new credit habits isn’t glamorous, but it’s the difference between slow progress and steady growth. Secured credit cards for bad credit give you a built-in structure to keep routines simple and rewarding.

Checking your balance weekly, instead of waiting for statements, prevents accidental overspending and late payments. Treat your card like cash—”if I don’t have the cash, I don’t spend it.” This mindset limits credit stress.

Micro-Habit 1: Calendar Debt-Free Days

Mark your calendar with a recurring “Pay Card” event each payday. Say aloud: “I’m paying off my balance today. No delays, no surprises.” This anchors payment as a regular routine.

By committing to a repeatable phrase and a visual calendar reminder, you sidestep the inertia that lets balances spiral. Consistency breeds confidence and visible score progress month after month.

If you slip up once, get back on script the next day. One mistake doesn’t erase ten good habits—keep moving forward.

Micro-Habit 2: Weekly Balance Snapshots

Open your card app each Friday morning before buying lunch. If your balance is over $50, transfer money now. “Clearing the deck before the weekend keeps me safe,” you might tell yourself.

This Friday check-in also helps you spot odd charges or errors fast. Acting right away means faster resolutions, less stress, and a perfect bill at month’s end.

Over time, these habits shift your focus from bill anxiety to pride in your progress, tracking each week’s improvement with a quick morning glance.

Putting the Pieces Together: Secured Card Success for Bad Credit Rebuilders

Secured credit cards for bad credit serve as a practical tool—one that delivers real results when handled strategically. Approval odds increase, new habits take root, and credit scores start climbing with every on-time payment.

This topic stays relevant as more people seek reliable, realistic ways to leave past setbacks behind. There’s nothing flashy about steady progress, but it’s the surest way to move from bad credit to better opportunities.

A well-managed secured card isn’t just a second chance; it’s a toolkit for future success. Use every payment, statement, and positive habit as evidence that you’ve reset your path—and let that momentum guide you into bigger, brighter credit milestones.