Personal Loans

Essential Guide to Personal Loan Prepayment Penalties in the US

Diving into personal loan prepayment penalties can reveal hidden costs. Learn how different penalty types work, how to negotiate, and exact steps for smart early loan payoff strategies in the US.

Advertisement

Paying off a loan early sounds like freedom, but a hidden fee can catch borrowers by surprise. Personal loan prepayment penalties can turn a big financial win into a cost you never suspected lurking in the paperwork.

Understanding these penalties matters for anyone expecting extra cash from a bonus, inheritance, or hard work. If you plan to close a personal loan early, you need clarity on the extra charges some lenders enforce.

This guide walks you through every corner of personal loan prepayment penalties—examining concrete rules, clear examples, and practical tips you’ll use whenever loan payoff crosses your mind.

Identifying When Prepayment Penalties Apply Saves Money Right Away

Lenders use personal loan prepayment penalties to secure the income they lose if customers repay early. Knowing exactly when this penalty kicks in helps keep your payoff plan on track.

Before you get a loan, ask for the prepayment penalty clause in writing. Don’t just accept a verbal assurance from a banker or online form. You need details.

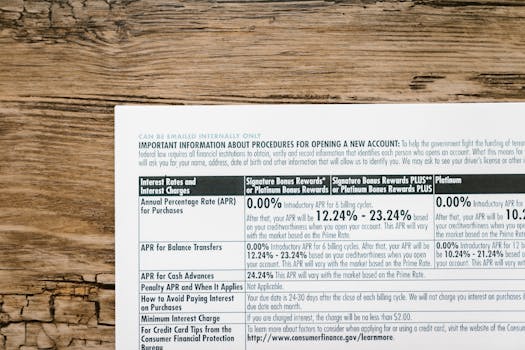

Direct Language in Loan Agreements Reveals the Fine Print

Most contracts will call this fee a “prepayment penalty,” but some use phrases like “early payoff charge” or “prepayment fee.” Highlight these in your own copy of the document.

If you read, “Borrower shall pay a fee equivalent to 3% of original balance if paid before term ends,” copy that line into your notes for later reference. Don’t gloss over jargon.

As soon as you spot this rule, mark calendar reminders for any window during which penalties do not apply, such as the last six months of a loan.

Lenders Often Set Penalty Windows—Check Date Ranges Carefully

Some personal loans only penalize early payoff in the first year or two. Catch this by looking for language such as, “This applies within 24 months of loan origination.”

Mark relevant dates on your phone and keep the documentation handy. If you pay after the window, you’ll likely avoid the fee entirely—timing makes a difference.

“We’ll pay extra on month 25” is a script you could say to a lender if that’s when the penalty expires. Planning ahead gives you better control.

| Lender | Penalty Percentage | Penalty Applies Within | What to Do Next |

|---|---|---|---|

| Bank A | 3% | First 24 months | Set reminder for month 25 payoff |

| Credit Union B | No penalty | None | Pay any time, penalty-free |

| Online Lender C | 2% | First 12 months | Check exact close-out date |

| Lender D | 5% | Any time | Calculate if early payoff still saves |

| Finance Co. E | 1% | First 36 months | Choose payoff month for best outcome |

Common Prepayment Penalty Types—and How to Spot Each One

You’ll see different prepayment penalty structures depending on the lender and product. Each comes with unique calculations. Spotting them up front makes your decision smoother and less stressful.

Personal loan prepayment penalties fit into three categories: a flat fee, a percentage of the remaining balance, or a percentage of total interest expected. Use these terms when comparing loan offers.

Reviewing the Flat Fee Penalty—What to Expect

If you spot wording such as, “$250 early payoff charge,” that’s a flat fee structure. You’ll owe the same amount no matter your loan size or repayment timing.

This penalty hurts most on smaller loans. Watch for it if you’re borrowing less than $10,000, since a $250 penalty can eat up interest savings quickly.

- Ask for a dollar-amount breakdown: It clarifies total cost.

- Cite the fee during negotiation: This can motivate a lender to drop it.

- Base your timing on fee size: Larger fees mean waiting may save more.

- Plan ahead in writing: Get confirmation before the repayment window opens.

- Compare interest saved with penalty: Do the math immediately, not after payoff.

Choosing a lender without flat fees is ideal if you intend to pay early. These fees tend to be non-negotiable once the contract is signed.

Percentage-Based Prepayment Penalties Create More Variables

Some lenders write, “3% of remaining balance if paid early,” into the contract. The earlier you pay, the greater the penalty in dollars.

This setup requires extra math when analyzing your options. Run detailed calculations before committing to any repayment schedule or lump-sum payment.

- Check the declining balance: Early payoff increases the penalty.

- Ask for an example sheet: Lenders should break down hypothetical numbers for your case.

- Consider waiting until later in the loan: Each payment reduces the balance and the penalty.

- Calculate your true interest saved: Compare this with the penalty charged.

- Log everything: Keep written records of all lender correspondence and confirmed fees.

This type of penalty rewards careful monitoring and planning. Adjusting repayment date by even a month can lower costs noticeably.

How Personal Loan Prepayment Penalties Influence Repayment Strategy

Knowing exactly what triggers personal loan prepayment penalties changes how you approach both budgeting and debt management, making payoff goals more realistic from day one.

The penalty structure influences whether you pay off principal or stick to the preset schedule. Matching your plan to your contract’s details protects your bottom line.

Careful Scheduling Drives Better Results

Successful borrowers set reminders for penalty windows, ensuring payoffs happen when fees don’t bite. For example, saying, “Let’s schedule extra payments for month 13,” if the penalty ends after 12 months.

Marking a loan’s critical dates on paper and setting phone notifications ensures no detail gets missed. Good organization translates to money saved.

Having all dates visible also eases planning if you pay off more than one loan at once—penalties can differ between products.

Communication Scripts Make Lender Discussions Smoother

Saying, “Can you confirm the current prepayment penalty as of today?” before transferring funds prevents misunderstandings. Keep calls short and stick to this script for clarity.

Requesting an emailed payoff document saves time and creates a paper trail if there’s any dispute later on the penalty’s size or existence.

Clear, friendly communication—never rushing—solves issues faster than arguing or speculating about policy nuances.

Loan Types and Their Typical Prepayment Rules You Can Compare

Personal loan prepayment penalties differ vastly depending on whether your loan is secured, unsecured, or comes from a traditional bank versus an online lender.

Comparing across options before signing can reveal which product fits your risk level and flexibility preferences best.

Secured vs. Unsecured Loan Penalties Show Major Gaps

Secured loans like auto title loans or home equity products may carry stiffer penalties for early payoff, since lenders expect a longer revenue stream.

Unsecured personal loans—especially newer fintech products—sometimes offer no prepayment penalty at all. Read each product’s terms carefully to spot these discrepancies.

Choose an unsecured product for maximum payoff flexibility if you expect to pay early. Ask directly, “Are there any prepayment penalties?” before agreeing.

Traditional vs. Digital Lenders Use Distinct Language

Brick-and-mortar banks may use more formal documents and less transparent penalty clauses. Digital lenders tend to put prepayment penalty info in FAQ sections or summary boxes.

Double-check both the loan agreement and the company’s website for consistency. Print or save official screenshots to confirm your understanding.

Trust actions, not just reassurances. If a digital lender puts “no prepayment penalty” in bold but the contract disagrees, clarify before signing.

Why Some Lenders Charge Personal Loan Prepayment Penalties and What That Means for You

Lenders set personal loan prepayment penalties to minimize lost interest when borrowers pay ahead of schedule, but reasons can also tie into business models and risk profiles.

Grasping the “why” lets you respond strategically: sometimes, a penalty is negotiable or may be waived if you ask the right way.

Interest Revenue Drives the Penalty Logic

Every loan comes with an interest expectation over its term. Paying off early cuts that revenue, prompting lenders to add penalties as insurance against lower profits.

For example, a lender may budget for three years of interest, and your early payoff interrupts their plan. Expect stricter enforcement from banks that depend on loan income.

Use language like, “Can we discuss waiving the penalty if I refinance with you?” when negotiating payoff terms with these institutions.

Business Model Differences Influence Fee Size

Traditional banks and credit unions may have fixed policy with less wiggle room. In contrast, some online lenders can skip or reduce prepayment penalties if you show steady payment history.

If you have a personal rapport with a loan officer, ask, “Could this fee be reviewed given my excellent payment history?” Courteous, direct requests sometimes produce results.

You’re more likely to see flexibility reviewing penalties at smaller, relationship-focused institutions or digital-first platforms willing to compete for repeat business.

Simple Steps to Negotiate or Minimize the Impact of Prepayment Penalties

There are practical, actionable steps you can take to reduce or avoid being hit with a prepayment fee. The process begins before you ever sign a loan contract and continues through your repayment period.

Gathering knowledge ahead of time—then acting on it—improves your loan’s bottom line.

Key Negotiation Tactics for New Borrowers

Before signing, say, “I’d like to proceed only if the contract is prepayment-penalty free.” Ask for written confirmation with signatures or email paper trail attached.

If the lender hesitates, respond, “Could we change or limit the penalty period to 12 months, maximum?” Pushing for amendments before closing changes the terms in your favor.

Don’t rush. It’s standard to ask for a few days to review final documents, especially with personal loan prepayment penalties in play.

Payoff Planning and Ongoing Communication Tips

Log all payment dates and penalty periods on a spreadsheet. Draft an email, “Please confirm my current penalty schedule before I make the next payment,” before taking any action.

Stick to factual language in all correspondence. That keeps conversations efficient and prevents misunderstandings later—especially if you escalate the issue or seek a waiver.

Always compare the math: see if paying early (even with a penalty) saves more than sticking to the regular loan term. That number guides your final decision.

Concrete Examples: Realistic Scenarios with Scripts and Calculations

Seeing real-world examples makes the mechanics of personal loan prepayment penalties clearer and helps you spot smart moves for your own payoff calendar.

Let’s break down two practical scenarios you’re likely to encounter when managing personal loans.

Scenario One: Paying Early with a Percentage Penalty

Maria wants to pay off her $8,000 loan with 22 months left and a 2% penalty on the remaining balance. She notes, “That’s $160 if I clear it now.”

She checks—her interest savings add up to $320 over that period. She decides, “Paying now still saves me money, penalty and all.” She emails the lender requesting the official payoff letter.

If interest savings had been less than the penalty, she’d have waited until the penalty window closed. Always do the side-by-side math first.

Scenario Two: Flat-Fee vs Zero Penalty Comparison

Kevin faces a $300 flat prepayment fee from a traditional bank on his $4,500 loan. Meanwhile, an online lender offers him a no-penalty refinance.

He says, “Even with application fees, the online route saves me money in total cost. I’ll take the penalty-free lender.” He gets approval and pays off the old loan.

If you find a better deal with zero prepayment penalty, confirm new terms before paying off the original loan. Double-check for hidden fees before making the switch.

Finish Strong—Your Next Steps for Smart Loan Payoff Planning

The real cost of a personal loan doesn’t always show until you try to pay it off early. When you spot, calculate, and plan around personal loan prepayment penalties, you make smart, confident steps toward debt freedom.

Rather than accepting lender rules as fixed, review the contract, negotiate up front, and keep lines of communication open at all times. Proactive strategies shield your finances from unwanted surprises and maximize your savings potential.

Whether you’re choosing your next lender or plotting the payoff day circled in red, remembering these penalty insights ensures your money works smarter, not harder. Use this guide each time you weigh early loan repayment, and never forget to double-check your loan’s fine print.