Credit Cards

Negotiating Lower Credit Card Interest: Your Step-By-Step Guide

Take real action to negotiate lower credit card rates with clear scripts, checklists, and timing strategies. Empower your financial decisions and save money by being your best advocate today.

Advertisement

If you’ve ever glanced at your credit card statement and wondered why the interest is so steep, you’re not alone. Many want to know how to negotiate lower credit card rates but aren’t sure where to start.

High interest can quietly eat away at your budget. Lowering it can free up monthly cash and jump-start your progress toward financial freedom or debt payoff. It’s more doable than it seems.

This article breaks everything down, giving you realistic examples and steps you can actually use. Discover how to have the right conversation and take action with your card issuer today.

What To Prepare Before Your Rate Negotiation Call

Getting prepared before talking to your issuer directly sets up a smoother call. You’ll want your facts, payment history, and a goal for your new rate ready to go.

This advance work makes the process feel less risky. When you learn how to negotiate lower credit card rates, information is your best leverage in the conversation.

Your Account Review Checklist

Review your full account history—look for on-time payments, no missed bills, and increasing your credit limit. Issuers respond better when they see evidence of responsible use.

Highlight any period where you paid more than the minimum. Note if your credit utilization has gone down compared to when you opened the account. This shows your reliability.

Avoid glossing over late fees or missed payments. If any occurred, write a sentence showing how you corrected your behavior: “I set up automatic payments so I won’t miss another due date.”

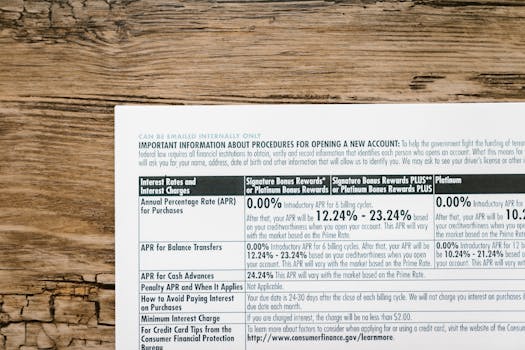

Setting Your Target APR

Benchmark your requested rate. Many major banks post ranges online—compare yours to these and your credit score average to see what’s realistic. This makes your ask more credible.

Aim for a specific number. Instead of saying, “Can you lower it?” try “Based on my strong payment history, I’d like a 13% APR, which aligns with current offers.”

Remember, aiming low is smart but trying for an ultra-low rate without reason backfires. Stay within the issuer’s published range for your score type and current offers.

| Issuer | Typical APR Range | Minimum Score Needed | Negotiation Tip |

|---|---|---|---|

| Big Bank A | 14.99% – 25.99% | 670+ | Emphasize loyalty and good payment record |

| Online Bank B | 12.99% – 22.99% | 700+ | Mention competing rate offers |

| Credit Union X | 9.99% – 18.99% | 650+ | Highlight local relationship/history |

| Subprime Card Y | 23.99% – 29.99% | 600+ | Request temporary hardship reduction |

| Premium Card Z | 15.99% – 20.99% | 740+ | Point out top-tier credit score |

Effective Scripts for Talking to Customer Service

Using assertive, polite language on your call boosts your chance of success. Scripts give you wording to fall back on, even if nerves hit mid-conversation.

These tried-and-true phrases help you keep control, keep emotions steady, and keep the issuer focused. Practicing before calling helps you stay confident, especially when learning how to negotiate lower credit card rates under pressure.

Opening the Conversation

Start with a clear, friendly tone: “Hello, I’m reviewing my current interest rate and account. I’ve been a loyal customer for years and always pay on time.”

Maintain steady pace and pause if the rep interrupts or asks questions. Keep your voice low and steady, avoiding rushed or defensive tones.

- Practice before calling, speaking out loud as if to a friend or mirror. This helps your request sound natural.

- Open with a positive remark about your history with the company to build rapport immediately.

- Use plain words—no need for technical jargon or complex explanations. Simplicity reads as humility and teamwork.

- Stay concise. Rambling dilutes your core request and loses the rep’s attention, so rehearse your opener in advance.

- If stumbling, take a breath and ask for a moment to collect your thoughts. Issuers appreciate direct but measured callers.

End your opener with your goal: “Based on my history, I would like a rate closer to 13%. Are there options available for customers like me?”

Handling Objections and Pushback

If the rep hesitates, stay calm and thank them for looking into it. Respond with: “Is there a balance transfer offer, or could I qualify for a temporary reduction?”

State your reasons again if necessary, but without sounding argumentative. “My payment history shows my commitment. Are there supervisor-approved programs I can consider?”

- Ask directly for a supervisor if front-line staff can’t approve changes and repeat your script calmly to the new contact.

- Emphasize your willingness to stay but also allude to exploring other cards—“I’ve received other offers with better rates; I’d like to stay loyal if possible.”

- Don’t argue. If declined, thank them and ask if you can call back next quarter after improving something specific, like your balance or account standing.

- Write down the name and extension of everyone you speak with in case you need to reference your call later.

- Even a small reduction can save money. Accept interim offers, then mark your calendar to try again in three months.

Conclude with gratitude: “Thank you for your help reviewing my account. I appreciate any consideration you can provide.”

Knowing What to Say and When to Say It

Timing shapes outcomes as much as what you say. Calling right after a successful payment streak gives your request the most power. You’re presenting the best possible version of yourself.

Phrase your requests to match your account status. For instance, if your credit has improved significantly in recent months, highlight: “My credit score increased by 60 points since January.”

Pacing Your Requests

Start small: Aim for a minor rate reduction, wait for a response, then ask about further programs. This avoids overwhelming the rep with too many requests at once.

Always clarify the terms: Ask, “If my rate is lowered, does that affect my rewards or benefits?” Being specific keeps unintended consequences off the table.

If the rep says the offer only lasts six months, respond: “I’ll accept the temporary offer and would like to reevaluate at the end of the period.” Mark it on your calendar, then follow up.

Blending Personal Touch and Numbers

Blend facts and a brief personal context: “I’m working to pay down my balance faster and support my family’s budget goals.” This gives reps a human reason to help, while staying focused on numbers.

Be transparent if you’re facing hardship. “Due to a recent medical bill, I’m trying to reduce my financial stress by lowering my interest rate.” Offer to provide supporting documents if it helps.

Maintain clear boundaries. Accept offers that meet your minimum needs, but politely decline those with hidden fees or conditions that won’t help your situation. Stay firm and respectful throughout.

Comparing Other Options to Negotiating Directly

Direct negotiation is not your only option. Balance transfers and personal loans might offer a better rate, especially for people with good or improving credit scores.

Comparing these options side by side lets you see where the most savings are. Learning how to negotiate lower credit card rates doesn’t mean ignoring outside offers completely.

When Balance Transfers Make Sense

Balance transfers work best if you have a high balance and qualify for a 0% intro APR. Look for transfer fees and the duration of the zero-interest period to calculate savings.

If approved, your strategy shifts from negotiating to maximizing that interest-free period—set calendar reminders for when the promo ends and pay as much as possible each month.

After transferring, call your original issuer and let them know. Sometimes this prompts a rate reduction or improved offer so you’ll return your business after the promo rate ends.

Using a Personal Loan for High Interest Debt

Personal loans can consolidate multiple cards at a lower fixed rate. The monthly payment and timeline are set, helping with budgeting and reducing total interest paid over time.

Check that your loan has no prepayment penalty. Use a loan calculator to compare your current total interest versus the new payment setup to confirm it’s worth switching.

If you take out a personal loan, use the proceeds to pay your card off completely the day the loan funds arrive. Then, close unused cards carefully to avoid hurting your credit score.

Pacing Your Calls and Avoiding Common Traps

Spacing out your negotiation attempts keeps relationships friendly. Calling too frequently can flag you as a risk customer, but a well-timed follow-up puts you back on their radar.

Track offers and denials in a notes app or notebook. Documenting what worked, who you spoke with, and when to call again helps you refine your approach over several months.

Signs Your Timing Is Off

If your recent history includes late payments or missed minimums, wait until you’ve repaired this pattern before calling again. Three consecutive months of early payments says more than promises alone ever could.

Calling during peak hours or just before a payment is due can lower your chances. Consider calling on weekday mornings, when reps are fresh and more willing to be helpful.

Mark your calendar after each call. An example note: “Jan 3 called, spoke to Lisa, did not qualify. Plan to pay on time for two months, try again in March.”

Scripts for Common Pitfalls

If the rep says, “Our system won’t let me adjust your rate right now,” respond, “Thank you for checking. When should I call back so my recent payments count toward eligibility?”

If told rates aren’t negotiable, reply, “Can my account be reviewed by a manager or specialist who handles these requests?” Many issuers have escalation paths not advertised upfront.

If you freeze up, take a pause. Say, “Let me gather my notes. Can you hold the line?” This stance shows you’re prepared and persistent, not just winging it.

Staying Organized with Follow-Ups and Documenting Offers

Tracking your requests ensures you know what was offered, when, and by whom. Relying on memory risks missing deadlines, forgetful reps, or losing your place in a long back-and-forth.

Create a simple spreadsheet, a notes app, or a dedicated notebook. Capture the date, outcome, name of the representative, terms offered, and when you plan to reach out again.

Maintaining a Paper Trail

Request confirmation emails or written statements for any new terms, especially if you accept a temporary or promotional rate. This record protects you if a future statement doesn’t match what you agreed on.

If you receive oral promises, politely ask for documentation: “Could you email that rate confirmation to my address on file?” Attach any emails or letters directly to your record for quick reference.

Match your notes to every future conversation. Start each call by recapping the last outcome, using the rep’s name for clarity and continuity: “Last month, Linda agreed to revisit my rate today.”

Calendar Planning for Review

Set reminders to check in at intervals that match the issuer’s policy—typically every three or six months. Use clear labels: “Review rate with Bank A,” followed by the past result.

Prepare questions for follow-up. “Are new customer offers still better than my current rate? What would it take to qualify for your best rate this quarter?” Jot down the answers for your records.

Remind yourself to celebrate progress, even small wins. Every reduction, no matter how incremental, cuts your interest and boosts your long-term financial health.

Choosing the Best Next Step For Your Situation

Throughout all these strategies for how to negotiate lower credit card rates, acting matters more than waiting for a perfect moment. Each step gives you leverage for the next call.

Your journey will look unique, but being organized, prepared, and polite is always advantageous. Track your calls and offers to steadily move toward lower interest and less financial stress.

Try a simple approach this week: choose a script, pick a calm time to call, and take notes during the conversation. Small, consistent actions will help you save money and gain confidence.