Financial Guides

The Ultimate Guide to Managing Debt Responsibly: Practical Steps for Financial Confidence

Explore this comprehensive guide to how to manage debt responsibly and gain tools, checklists, and real-world strategies for a clearer, healthier financial future—no hype, just action.

Advertisement

Buried by statements, juggling due dates, and worrying about credit health can leave anyone feeling stuck. The path to stability starts with small, manageable actions. Finding out how to manage debt responsibly isn’t just a financial skill—it’s the gateway to peace of mind and healthy future choices.

Personal debt continues to shape countless lives across the United States. From student loans to credit cards, effective debt management determines not just monthly budgets but also long-term opportunities and everyday stress levels.

This guide equips readers with real steps and examples that break debt down into solvable parts. Read on for tools, checklists, and practical examples—everything you need to act with confidence and clarity.

Building a Clear Picture: Audit and Understand What You Owe

To manage debt responsibly, start by mapping out every debt you have. This isn’t just a list—it’s a blueprint for progress and a safety net against missed obligations.

Begin by opening every lender statement—no matter how small the balance. Use a dedicated notebook, spreadsheet, or budgeting app to record balances, minimum payments, interest rates, and due dates side by side.

Implementing a Debt Inventory Habit

Each month, commit to a 15-minute review. Say aloud, “Did any balances go up or down?” If something changed dramatically, note why. This routine prevents overlooked rate changes or snowballing late fees.

Consider analogies: Think of your debts like plants. Some grow (interest accumulates), some wilt (when you make payments). Keep track so nothing gets out of control.

After your review, schedule next month’s check-in. Copy this calendar reminder: “Debt inventory review—keep my finances clear.” Treating the process like routine plant care reduces overwhelm.

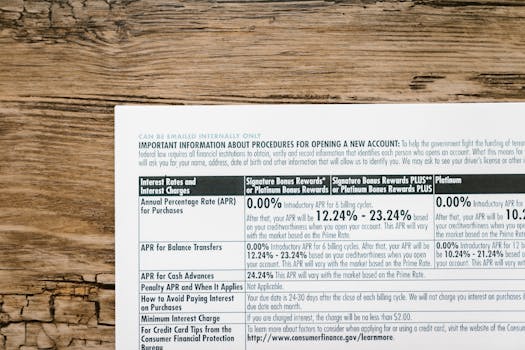

Pinned vs. Variable Debt Scenarios

Pinned debts have set rates and schedules. Variable debts, like credit cards, can fluctuate. For pinned debts, copy this phrase into your list: “Fixed—review annually.” For variable, set alerts to check every month for changes.

When you spot a rate hike, take the small step of calling the lender. Say, “I noticed my APR increased. What triggered that?” Sometimes a quick call prevents bigger issues down the line.

This approach turns review from a chore to an information-gathering routine—no guesswork needed. It’s a core strategy in how to manage debt responsibly.

| Type of Debt | Typical Interest Rate | Minimum Payment Structure | Why Tracking Matters |

|---|---|---|---|

| Credit Card | 16%–24% | Percent of balance or flat fee | Balances can quickly increase, missing a minimum induces penalties |

| Student Loan | 4%–8% | Fixed monthly | Eligible for special repayment options; knowing balances helps you plan |

| Auto Loan | 3%–8% | Fixed monthly | Missing payments risks repossession, knowing payoff amount aids refinancing |

| Mortgage | 3%–7% | Fixed monthly | Impacts credit and housing security, tracking aids future refinance decisions |

| Personal Loan | 7%–12% | Fixed monthly | Often has higher rates; tracking can motivate aggressive repayment |

Strategic Payment Planning: Prioritize and Execute

A good repayment plan puts you in the driver’s seat. Identifying which debts to tackle first reduces stress and accelerates progress. The right strategy keeps you focused and motivated throughout the journey.

Two popular repayment methods are the avalanche and snowball. Understanding each method’s benefits—and fitting them to your situation—maximizes long-term wins.

Comparing the Avalanche and Snowball Methods

The avalanche method tackles high-interest debts first, saving you the most in the long run. List debts by interest rate, then pay extra toward the highest-rate balance while paying minimums on the rest.

With the snowball method, list debts by balance size, paying off the smallest first. Early wins provide psychological momentum, fueling you to keep going as larger balances shrink.

- List all debts and categorize by interest rate for the avalanche, or by total owed for the snowball. This groundwork drives the repayment method and reveals quick wins.

- Choose avalanche to save on total interest payments. Use snowball if you need motivational boosts from early successes. Avoid switching between methods once committed—consistency leads to better outcomes.

- Schedule automatic payments for minimums. Manually make the extra payment each month; seeing this action reinforces your commitment to responsible debt management.

- Review progress every three months. If a balance doesn’t drop as expected, double-check accounts for unaccounted fees or errors. Immediate troubleshooting preserves momentum.

- Once a debt is cleared, reallocate that payment to the next target without lowering your total monthly repayment amount. This creates a snowball effect, magnifying results.

Effective payment planning is a foundational step in how to manage debt responsibly—combining structure and motivation in an actionable plan.

Building Your Emergency Buffer

Unexpected expenses can throw payment plans off course. Create a dedicated savings buffer, even if it’s small at first. Label it “Emergency Debt Backstop” to reinforce its purpose every time you add to it.

Every paycheck, direct $25–$50 to this buffer until you reach a $500–$1,000 target. If an emergency hits, you’ll have a safeguard—no high-interest reliance needed.

- Automate transfers to your emergency buffer each payday to build resilience gradually and reduce temptation to spend. Small, regular moves add up over time and provide genuine financial security.

- Only use the buffer for true emergencies, like car repairs or unexpected medical bills that could derail your payment plan. Pause other extra payments if you need to top it back up.

- Check buffer levels quarterly. If you dip below your minimum, shift your focus to rebuilding it, then resume aggressive debt payments. Protecting your buffer protects your progress.

- Name the account intentionally—like “Goal: Stay on Track Fund.” This label nudges you to treat the buffer as truly off-limits for non-emergencies, supporting wise decisions during moments of stress or temptation.

- When you reach your initial buffer goal, celebrate the milestone. Treat yourself with a free or low-cost reward—like a hike or favorite home meal. Recognize every step forward.

Pairing strong payment plans with a sensible emergency buffer is a core element in how to manage debt responsibly. This dual approach cushions setbacks while speeding up your overall progress.

Negotiating Lower Payments: Make Lenders Work with You

Negotiating payment terms helps you regain control when repayment feels unmanageable. Lenders benefit from your continued payments, so proposing changes isn’t just possible—it’s reasonable and plays a big role in how to manage debt responsibly.

Start with detailed documentation: balances, due dates, income statements, and a realistic snapshot of what you can pay monthly. Preparedness conveys commitment, not desperation.

Approaching Creditors Proactively

Call creditors early—before missing a payment. Clearly state, “My financial situation changed. I want to keep paying, but I need a lower monthly amount.” This shows intent to honor your debts.

Follow up in writing via email or app message to document the call. Say, “Thank you for discussing options. Here is my understanding—monthly payment of $X for Y months, then revisit.”

Stay polite but persistent. If the first answer is a refusal, respond, “Is there a supervisor I could speak with about payment relief options?” Sometimes, escalation unlocks solutions unavailable at the first point of contact.

Scripted Examples for Securing Better Terms

When negotiating, use short direct language: “I’m asking for a temporary interest rate reduction for six months.” Offer realistic figures and avoid pressing for too much at once. Lenders are more likely to help if you’re flexible.

If offered a hardship plan, ask, “Does this impact my credit report, and how will payments be reported during this period?” This information lets you weigh trade-offs and make an informed decision.

End each conversation by repeating the key details and confirming next steps, e.g., “Just so we’re clear—I’ll pay $120 per month for the next half-year, and then we’ll reassess together.”

Using Financial Tools and Apps to Stay Organized

Leveraging technology streamlines debt management and turns what could be hours of paperwork into a five-minute daily check. Apps, reminders, and online dashboards work together to reinforce how to manage debt responsibly with minimal hassle.

Pick tools with clear dashboards and notifications. Prioritize ones that pull all debts into a single view, preventing details from slipping through the cracks and keeping your strategy on track.

Linking Accounts and Tracking Progress

Most major banks and debt-tracking apps let users sync all accounts—including those outside their bank. Link credit cards, loans, and even forgotten old accounts for a full picture in one place.

Set up custom payment reminders. Opt for notifications three business days before each due date. This avoids missed payments and keeps stress levels low, even in busy times.

Use the app’s built-in progress charts to visualize progress monthly. Mark each paid-off debt with a celebration—these apps sometimes include virtual confetti or badges, which brighten routines and keep you motivated.

Security Habits and Digital Protection

Enable two-factor authentication whenever it’s offered by a finance app. This adds an extra layer of security to your sensitive info without requiring complex technical know-how.

Log out fully after each session if using shared devices. If you spot suspicious activity—a login you don’t recognize—reset your password immediately. Most apps now offer a “secure access” report via email.

At least once every six months, review your app connections. Remove any accounts you no longer use, and update passwords to a unique combination for each site. Think of it as spring cleaning for your financial life.

Reframing Spending: Aligning Purchases with Debt Goals

Successful debt repayment requires more than tracking balances—it demands conscious day-to-day purchases in favor of long-term progress. Each spending choice reflects your commitment to how to manage debt responsibly and shapes your future options.

Aligning your budget with debt goals starts with intentional, pre-decision planning. Even small habit changes have a ripple effect when sustained over weeks and months.

Micro-Budgets by Category

Break down big categories into “micro-budgets.” Instead of $400/month on groceries, limit snacks or single-use treats to $25, or set a $10 coffee-shop cap each week.

Use cash envelopes or prepaid cards for these smaller budgets. When the envelope is empty, the spending ends—guiding honest decisions in the moment.

This approach simplifies budgeting, helping you spot risk areas without overhauling your entire lifestyle in a single attempt. Small, sustainable changes build lasting habits.

Habit Checklists for Daily Decisions

Before each discretionary purchase, pause and ask, “Will this purchase slow my debt repayment?” If the answer isn’t a clear yes, redirect that money toward your current target balance.

Leave a sticky note on your wallet with a message, “Think debt freedom.” This physical cue interrupts autopilot spending and builds momentum with every wise choice.

At the end of the week, tally bonus savings from skipped non-essentials and apply it to your next payment, accelerating your debt payoff visibly.

Celebrating Milestones without Breaking Your Progress

Marking major milestones—like closing out a card or reaching half your goal—sustains motivation. However, every celebration should fit the budget to reinforce your momentum, not sabotage it. Choose actions aligned with how to manage debt responsibly.

Low-cost and creative rewards cement the connection between hard work and positive outcomes, making it easier to stick to your plan for the long haul.

- Plan a home movie night with favorite snacks instead of a costly dinner out. You’ll enjoy genuine celebration while keeping savings working for you.

- Schedule a walk in a nearby park with friends to mark your progress. Quality time—without spending—strengthens motivation and commitment.

- Write a list of lessons learned after each paid-off debt. Reflecting on growth keeps you focused on progress instead of immediate gratification.

- Share a recap of your milestone in a trusted group chat. Public celebration brings encouragement and accountability, anchoring good habits for your next big win.

- Use habit trackers—digital or on paper—to record streaks of wise spending, skipped impulse buys, or on-time payments. Visual success fuels the next step in your journey.

Your Debt-Free Blueprint: Keep Going and Thrive

Every step toward responsible debt management builds lifelong confidence. Recapping, you’ve learned how to manage debt responsibly by tracking, planning, negotiating, and making conscious daily decisions that steadily drive results.

Responsible debt management not only relieves financial pressure but also paves the way for future opportunities—whether pursuing housing goals, business dreams, or simple daily peace.

This journey is ongoing, but each action plants seeds for a healthier financial life. Remember: every small win counts. Your blueprint isn’t one-size-fits-all, but it’s yours to refine and celebrate—now and far ahead.