Credit Cards

What to Do If You Miss a Credit Card Payment

Missed a credit card payment? Get step-by-step fixes, prevent score damage, smartly reverse fees, and keep future finances stress-free. Recover fast and avoid repeat mistakes.

Advertisement

Ever realized a bill slipped your mind and your stomach dropped? Missing a credit card payment can feel that way — sudden, frustrating, and hard to fix in the moment.

Managing a missed credit card payment matters because your credit score, late fees, and peace of mind are on the line. Addressing it quickly can keep financial hiccups from turning into lasting headaches.

This guide offers practical, real-world steps to recover from a missed credit card payment and stay ahead. Let’s turn this slip into a manageable process — and avoid it next time.

Recognize Immediate Effects After Missing a Due Date

Once you realize a payment is overdue, you need to know exactly what has changed. This clarity helps you plan your next move with confidence.

A missed credit card payment typically results in a late fee, an interest rate hike, and potentially a negative mark on your credit report if not addressed fast enough.

Spot the First Red Flags: Fees and Notices

Your account’s online dashboard may display a red alert or fee charge after a missed credit card payment. The bank’s language ranges from polite reminders to urgent notifications.

Email subject lines use terms like “Past Due” or “Action Required”. Paper statements may arrive with bold, highlighted amounts. Reading these early keeps escalation to a minimum.

One action: Log in promptly after you spot a missed payment so you can review every flagged transaction, making it easier to prioritize what’s due right now.

Timeline for Credit Impact: When Scores Begin to Drop

Credit bureaus won’t record a missed credit card payment unless it’s 30 days late. If you act within this window, your score might not change.

At 30 days past due, lenders notify bureaus. Automated payments or reminders help prevent hitting this threshold, but you still have time to act before lasting credit damage.

Try this phrase when calling your card company: “My payment was late, but I’m resolving it now. Can you verify nothing’s reported to the bureaus yet?”

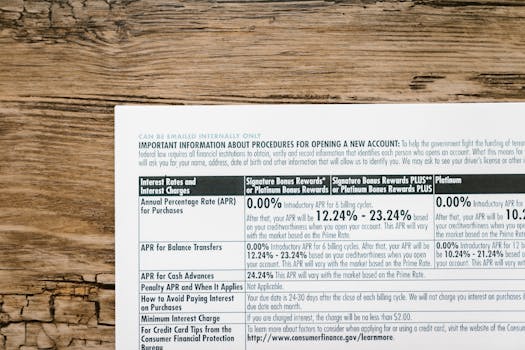

| Consequence | Triggers | Speed of Occurrence | Next Action |

|---|---|---|---|

| Late Fee | Payment due date missed | Immediate | Pay overdue as soon as you notice |

| Interest Rate Hike | Consecutive missed payments | After 2 cycles | Call issuer, negotiate terms |

| Credit Score Impact | 30 days late reported | After 30 days past due | Pay before it’s reported |

| Loss of Rewards | Account becomes delinquent | Varies by issuer | Pay, then request reinstatement |

| Account Closure | Multiple missed payments | 60–90 days late | Seek payment plan |

Take Action to Correct Payment Quickly

Paying right away spins you back on track. Every hour matters after a missed credit card payment, so initiate payment as soon as possible to minimize additional damage.

Most online payment systems can process an overdue payment the moment you realize the oversight. The sooner you pay, the faster normal account functions return.

Choose the Fastest Payment Channel

Mobile app transfers and instant online payments post nearly instantly. Phone payments work quickly as well, while paper checks can slow down your recovery.

Examples: Choose “Make a Payment” in your bank app and select today’s date. Or, call the card’s 800 number and follow spoken prompts to finalize that overdue amount.

- Settle the full overdue balance now to reset your billing cycle and future protect your credit score — partial payments delay the process.

- Enable same-day transfers using your linked checking account for immediate coverage of the missed credit card payment, removing any “Past Due” alerts from your dashboard fast.

- Request expedited posting if calling your card’s customer service; state, “Can you apply this immediately to remove the late status?”

- Confirm your payment posted by checking your online transaction history, so you’re not left guessing if you really closed the gap.

- Turn on real-time alerts for confirmation so you see the system update and keep your records as proof in case questions come up later.

Once the overdue balance is gone from your dashboard, confirm your next due date hasn’t moved or that there are no secondary penalties activated by your missed payment.

Negotiate Fee Waivers or Penalty Reversals

A phone call with your card issuer after your first missed credit card payment can save you substantial money. Customer service can sometimes reverse fees if you’ve previously paid on time.

Script to try: “This is my first missed payment. I’ve just paid in full — can you waive the late fee as a courtesy?” Stay friendly but firm, emphasizing reliability.

- Explain your positive payment history as leverage for flexibility: Remind them of years spent paying reliably before this recent slip-up.

- Give a brief, honest explanation like “I lost track this month; it won’t happen again,” establishing your intent to stay on top of things.

- Request reversal of interest charges directly, not just fees; sometimes both can be canceled if you act and ask quickly enough.

- Take notes during the call: write down representative names and confirmation numbers for future reference if issues aren’t resolved instantly.

- Follow up by secure online message recapping your phone conversation and outcome, solidifying your request in the issuer’s records.

Document every outcome from your customer service call so if you face another missed credit card payment later, you have a reference for negotiations.

Repair and Guard Your Credit Report from Lasting Harm

Timely recovery actions help keep your credit standing solid after a mistake. Even after catching up, there’s more you can do to protect your future applications.

Checking your credit report right after a missed credit card payment gives you insight if any negative mark appeared, ensuring you can dispute anything inaccurate immediately.

Monitor Reports and Dispute Early Errors

Order a free annual credit report from each bureau after dealing with the missed payment, then review the “Accounts” section line by line. Look for late payment notations dated wrong.

Step: If you spot an error, visit the bureau’s website and submit an online dispute form. Attach proof of payment with your account and transaction details for context.

If you catch a creditor mistake or old missed payment reports beyond seven years, request formal correction so your score reflects your real record, not a lingering slip.

Offset Score Drops with Positive Activity

After a missed credit card payment, make every subsequent payment early for several months. This trend can raise your score and show future lenders steady responsibility.

Set up autopay to cover the minimum by default in case memory fails again. Then, add manual reminders for the ideal payment date.

If your utilization shot up due to missed payments, pay down other balances. This quick action offsets score drops by lowering your overall usage and increasing available credit lines.

Move Forward with Better Habits and Prevent Future Misses

Learning from a missed credit card payment helps you build routines that safeguard your finances. Each setback can spark systems that promote ongoing responsibility and peace of mind.

Making use of alerts, scheduling tools, or autopay features increases the odds of catching due dates before they slip past. Consistency turns temporary stress into smooth, predictable payments.

Use your experience with a missed credit card payment to develop custom reminders and review routines. Small, steady changes now add up to less worry and a stronger credit journey ahead.